You don’t see it right away.

Just a few extra cents for milk. Eggs a little pricier than last week. But then it starts to build. The sneakers your kid needs? Thirty bucks more than last year. The new phone? Forget it, it’s not even a conversation. You need a car part, something basic and now it’s backordered and double the price.

That kind of pain doesn’t show up all at once. It sneaks in. Quiet. Subtle. Until you're standing at the gas pump, watching the numbers roll past $70, doing the math in your head, and wondering which bill you can push to next month without getting hit with a late fee.

This isn’t some abstract economic trend. It’s not inflation run wild or a blip on a chart. This is policy. And it’s personal.

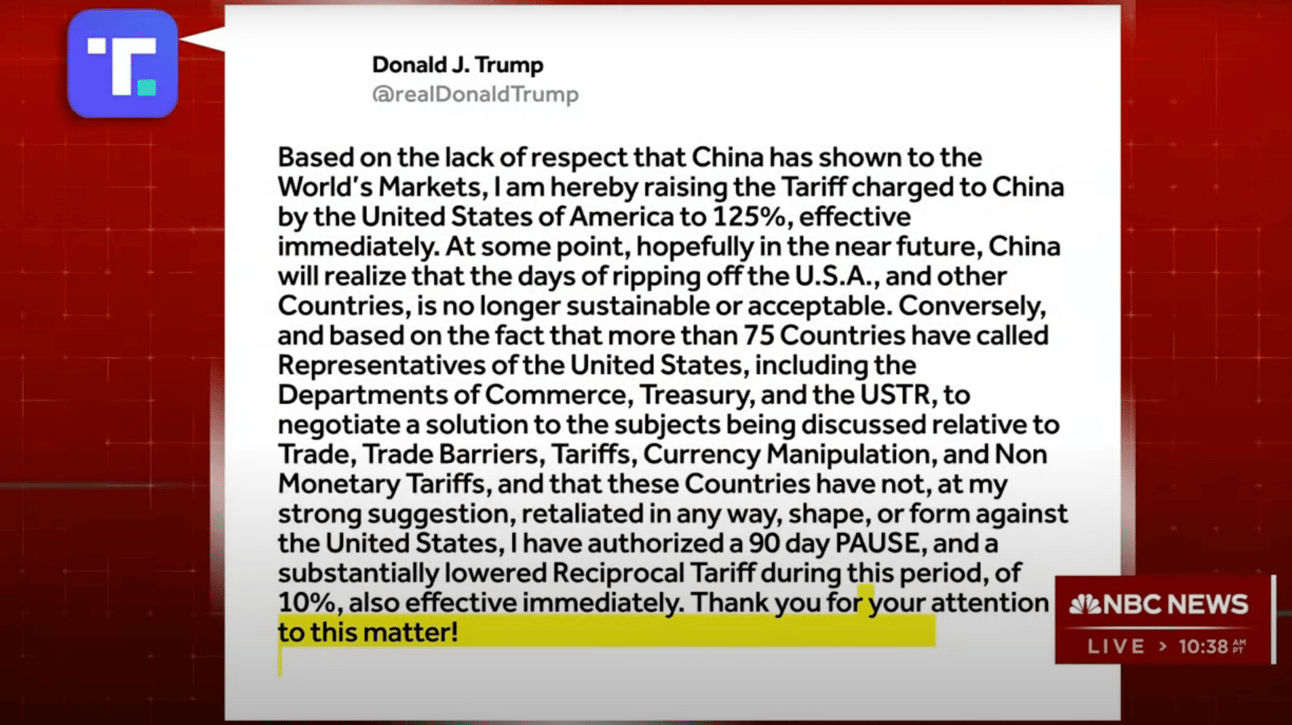

On April 9th, President Trump made his move: a 90-day pause on tariffs for some countries, while cranking them up on China.

This was damage control—plain and simple.

A response to the economic whiplash set off on April 2nd, 2025 from what the White House called "Liberation Day.” Where the U.S. government dropped a sweeping 10% universal import tariff. There were flags and grand speech, a moment that felt like history in the making. America is back, or at least, that was the pitch.

Within days, the administration rolled out a retaliatory framework aimed at 60 countries, each one handed its own custom-made tariff like party favors at a trade war. And by mid-week, things escalated fast, a threat to double down on China, jacking the rate up to a jaw-dropping 104%.

But not everyone was sold on the strategy. The shockwaves from the announcement were immediate, like pulling the pin on a grenade and tossing it into the global supply chain.

Somewhere in a Manhattan high-rise, Barstool’s David Portnoy watched and stared into the cold glow of a market that didn’t care about speeches. The Dow dropped fast — over 1,600 points the day after. Portnoy called it Orange Monday. In three days, he was down nearly $20 million. “Probably 10 to 15 percent of my net worth,” he said, half-laughing through the punch to the gut.

And yet—he stayed in character. “I’m still here. That’s the game,” he said with a shrug, like he’d just missed a putt, not a fortune.

It’s a great line. Meant to sound cool, unshaken. But listen a little closer, and there’s a crack in the confidence. The game rewards the bold, sure—but only if you know the rules but that’s the thing: most people don’t. Not really.

This wasn’t liberation, it was a bait-and-switch. A promise of control that evaporated at checkout. Portnoy lost millions. Regular people lost something more subtle—and more terrifying: the sense that they had a say in any of this.

This liberation won’t show up as a bigger paycheck. It will show up as a quiet tax buried in your grocery bill. In price of a new car and at the pump.

And that’s the real twist. The game didn’t change.

We just realized we were never playing it to begin with.

Let’s be clear…this isn’t liberation. It’s a revelation. The veil has dropped. What we’re watching isn’t a trade war—it is an admission that the system we’ve been sold is cracking under the weight of its own contradictions. If you’re waiting for the people at the top to fix it, don’t hold your breath. Most of them haven’t had to check the price of eggs in years.

The Game Beneath the Game

On the surface, tariffs look tough. A negotiating chip on the chess board disguised as economic policy. The story goes: punish the bad guys, protect our own, level the playing field. But scratch just a little deeper, and the story starts to shift.

Because when the world’s biggest economy starts taxing its own people in the name of leverage, that’s not strength—that’s strain. That’s not a strategy—it’s a smoke signal. And when friction shows up in partnerships that were once smooth and predictable, you’re not watching diplomacy. You’re watching a system quietly buckle.

This isn’t about trade deals. It’s about transformation. Something deeper is evolving. And if we’re not paying attention, we’re going to call it strength—right up until the moment it starts to break us.

We like to believe history moves in a straight line. That nations rise, stumble, learn their lesson, and rise again—clean, predictable, cinematic. But that’s not how it works. The past isn’t a roadmap.

It’s a warning label. A highlight reel of what’s possible—both the glory and the collapse.

It’s a bit like business. No one cares how you started. They care what you’re doing right now.

Take Rome. It didn’t fall in a single moment. It expanded through conquest, yes—but it collapsed under its own weight. Ambition turned to arrogance. Growth turned into overreach. Rome didn’t get crushed by enemies—it buckled under its own assumptions. It thought scale meant safety. That momentum meant inevitability. It believed power was permanent. It was wrong.

America’s rise? Totally different blueprint. No empire-building. Just invention. We industrialized, we wired the world, we built systems—financial, technological, and cultural—that moved faster than anything before them. From the factory floor to the fiber-optic cable, our strength wasn’t force. It was our imagination and innovation.

But now the ground is shifting again. Economic tension. Geopolitical friction. AI rewriting the rules in real time. The pressure’s building.

So no—the question isn’t whether America can survive. The question is: does it remember how it rose in the first place?

We built our power the old-fashioned way—in steel mills, car factories, and the engine rooms of the 20th century. America made things. We laid down railroad tracks, lit up skylines, and stamped “Made in the USA” on everything from toasters to television sets.

But now? The machines don’t need grease. They need data.

The 21st-century industrial age runs on algorithms, artificial intelligence, and robotics. We’ve swapped smokestacks for server farms, and somewhere along the way, we became the product. Our clicks, our preferences, our face in a camera—that’s the new fuel.

Here is the thing, we’re paying for this new industrial revolution. Not with dollars, but with something far more valuable—our attention, our privacy, our consent, even if we didn’t realize we gave it.

The real question is: do we understand the stakes?

Have we been careless with our consumption? Blind to what we’re trading? Have we handed over our role in the economy like it’s someone else’s job to care?

Because progress doesn’t just happen. Someone pays for it. And right now? That someone is us.

Pay attention to your value. Consumption drives 65% to 70% of the U.S. economy. We don’t just buy things. We fuel the system. And not just ours. Every time we tap, swipe, or click, we’re also boosting the GDP of other nations. That cup of coffee? That phone upgrade? That next-day shipping? It all adds up.

So yes, how much we spend matters. But where and with whom—that matters more.

Tariffs aren’t just taxes. They’re smoke signals, economic flares and right now, they’re lighting up a landscape that’s gotten chaotic—on purpose. Because in chaos, you’re forced to make a choice.

We’re being handed an opportunity. To stop, step back, and ask: Are we funding the future? Or just feeding a private-tech machines that figure out how to monetize our habits better than we can even understand them?

This isn’t a story about scarcity. It’s about stewardship. It’s not that we don’t have enough—it’s that we haven’t asked ourselves what we’re doing with what we’ve got.

And the moment we do? That’s when things start to change.

Right now we don’t control our economic destiny. Our wallets are being invaded and our value is being extracted.

This isn’t just economics and geo-political negotiations. It’s erosion of your agency and the reveal of your dependency.

The Price of Progress: Who Pays for the Comeback?

The pain we feel now is real. But it's not for nothing, it's the price of a bet. We're told these tariffs will bring back manufacturing, restore American industry, and reignite the economy and to some extent, that's true this path can create benefit. Jobs will return. Infrastructure will be rebuilt. American manufacturing will be great again.

But here's the question we are not getting the straight answer on, when those jobs return, who are they for?

Will it be people?

The answer may shock you, Commerce Secretary Howard Lutnick, in his interview with Face the Nation seemed to paint the picture.

The factories coming back to America will mostly likely be powered by robotics, AI, and automation. They will be managed by systems trained on human labor, behavior, skill set, and patterns. While we are paying for this economic shift today—with our data, at the register, at the gas pump, in rent— as consumers we are not guaranteed any share of what comes next.

We’re being asked to foot the bill for a system we’re not invited to own—and thanks to automation, one we’ll soon be excluded from entirely.

Data Is the Oil of the Machine Age

We are not just paying in dollars. We are paying in with our attention. Every move we make online feeds the intelligence that drives this next industrial revolution. Our behavior trains the machines that will run the factories, and our attention designs the platforms that will run the economy.

But you don’t have a stake in it.

In China, this process is state-run. Data is centralized under the government, and policy is built around that control. In America, where we thankfully live under a democracy, we have to choose to organize. We have to opt into ownership. The system won’t do it for us. But that also means we have power.

If we design systems where we control our data, our attention, and our digital identity, we can participate in this new economy—not just as consumers but as partners, stakeholders, and co-creators.

This isn’t just about economic independence. It’s about participatory design. This isn’t a call to protest. This is a call to participate. The tariffs are already here. The cost is already hitting. But the future is still up for grabs.

We have to design ourselves into the supply chain—not just as laborers and consumers, but as contributors of intelligence, sources of insight, and owners of the systems our data is building. You don’t need permission. You just need to say “yes” to choosing it and being a part of building it because if we don't choose it, someone else will design and own it without us.

I will say it again, this is not about Tariffs. It’s about who gets to own the future.

Tariffs are just an effect—a ripple we might have to get used to. A cost we may be forced to bear. But they’re not the solution. They’re not the what will move your life forward if we truly want to be stakeholders in what’s coming next.

Right now, the future is being built by the companies that control the platforms, own the data, and develop the technologies. The shareholders of those companies are positioned to own the value of the next industrial revolution—powered by AI, robotics, and machine intelligence and the rest of us? We’re footing the bill. Every time we spend. Every time we scroll. Every time we check the box “I agree.”

If we want more than just to pay for the future, we need a stake in it. If we want to participate in the race for what’s next, we need to choose how the future gets shaped. Tariffs aren’t the wave. They’re the wake. What’s happening beneath the surface is much bigger. We need to move from passive consumers to active participants. From extracting attention to intentional ownership, it starts with platforms that give us a seat at the table. Welcome to CoCreate Media.

CoCreate Media, where your time, your attention, your creativity—and your demand—become assets that works for you.

Where you can control your consumer demand and become a stakeholder in the platforms capitalize on your data.

This was never just about economics.

It’s about equity.

It’s about human potential.

It’s about your rights and agency.

The choice is here. The time is now.